Looking for Anomalies: Lessons from Jim Simons (Video)

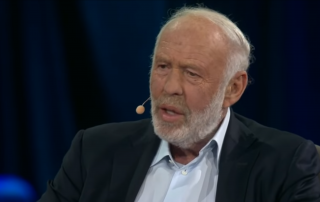

“Efficient market theory is correct in that there are no gross inefficiencies, but we look at anomalies that may be small in size and brief in time.” - Jim Simons, Founder, Renaissance Technologies Somewhere along the serendipitous journey, I had the good fortune to spend a flash of time with Jim Simons and a few key members of his team at Renaissance - see Jim Simons, Godfather of the Quants: Hiding in Plain Sight. He is certainly one of the great minds of the modern financial markets era - even if he might confess himself to be as or more lucky than smart - and among a short list of the most successful pioneers of the quantitative trading revolution. Now, one of the most amazing aspects about being in the presence of great minds is that they can shed significant pearls of wisdom so effortlessly, as if in passing. There's no drum roll or squadron of trumpets that precedes the statement of insight. It simply comes out - mixed with [...]